There are many factors that go into becoming a successful Amazon FBA seller, starting with understanding the profit margin you make with each sale.

After all, it’s not how much you make from the item that is sold, it is the profit margin once you count all your expenses.

To track the margin of profit you make every month will help you see the actual amount of money you pull in from your business.

This allows you to see how your e-commerce business is growing, identify new trends, and locate potential issues that might hurt your earnings.

This means that you will need to do a little bookwork in tracking your cost and sales, so you can calculate your profit margin.

Here is what you will need to do in help you understand the cost of what you are paying for and what you can do to make improvements.

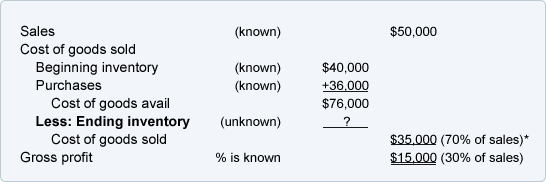

Assessing the Cost of Products Sold

This is where you compare the cost of the product to the sale price and note the difference.

The larger the difference in terms of sale compared to cost, the greater the gross margins you are earning.

This will open your eyes to the true revenues of your business and track if they are going up, staying the same, or going down.

To track the cost of a product, you will need to account for the following fees;

- Procurement

- Production

- Duties

- Listing

- Storage

- Taxes

Of course, this will depend on your business model. An affiliate marketing business does not store, purchase, or produce products, they only list and pay taxes on the profits as the goods come from other companies.

If you are producing or procuring goods, then you will need to account for what you pay every month.

However, keeping track of the goods you sell is not so simple as looking at the monthly reports, you will need to go further if you want an accurate picture.

Selling Widgets Example

As an example, let’s say that you are selling widgets which costs you $10 per item and you sell them for $20 each.

On the surface, you are making a 100% profit with each sale, but there is more cost involved than just how much you pay for them.

If you purchase 1,000 widgets, that’s $10,000. If you sell an average of 200 widgets per month at $20 each, you’ll earn $4,000 per month.

The correct way to look at the profit margins is to compare the cost of each widget with the price that it was sold. So, you paid $2,000 for the widgets that sold for $4,000 each month.

That’s a fairly steady profit you are making, even though you didn’t make up for the overall cost for nearly three months. Plus, it doesn’t account for other expenses.

For example, if you had to pay in shipping the widgets to your storage center, then that expense should be added to the cost of each item.

So, if you are paying an addition $1 per widget to have them shipped to your location, then your gross profit margin will be reduced from $10 per item to $9 per item.

Depending on the number of expenses, you may need to invest in a good inventory management software system, so you can see the expenses in total.

How Amazon Can Help

The good news for Amazon FBA sellers is that the taxomate program in Amazon, assuming it is available to you, can calcite your cost of product sales for you.

If you do not have access to the taxomate program, then you will need to do the calculations manually or with a third-party software system.

By using taxomate, you can have the numbers compiled into a report which allows you to see your profit margin month by month.

Having monthly reports like this enlightens you to the profit trends and allows you to spot increases or decreases readily.

It will take a few months to start establishing trends using the program, but the result is that once it is in place you’ll know where your profit margin stands and whether it is going up or down.

The taxomate can interface with other accounting software, such as QuickBooks Online or Xero.

Advantages of taxomate

There are several benefits to using this system, especially if you are just starting out and have little to no experience with other accounting software systems.

- Easy to Set Up and Use

- Automatically Imports all Amazon Transactions

- Provides Accurate Picture of Cost of Goods Sold

- Reduces Time Imputing Data and Researching Results

It only takes a few moments to load your Amazon Seller account info and gain access to the taxomate.

Once in place, it will automatically import all transactions on Amazon that FBA sellers use, so you don’t have to spend time doing it yourself.

Once in place, you can spend more time looking at the results which provides a window to the profit margins of your business efforts.

However, even the taxomate program does not account for all your expenses, so you will need to evaluate your business overall and see where other money is being spent.

This is because the taxomate system imports your Amazon data, looks at the sales to cost ratio, and then includes known expenses to create the cost of goods that are sold.

This is great assuming that it includes all your expenses and makes for a good resource in case you are audited.

In any event, Amazon FBA sellers would benefit greatly from using the taxomate program to help them accurately calculate cost of goods sold.

This provides a window into the success of your business efforts each month. Plus, you can look at additional expenses to see if your profit margins need to be increased.

Remember, it’s not how many items or goods you sell, it’s the profit margin you make from them that keeps you in business.

So, be sure to look over what you are doing and add the taxomate program for much needed assistance.

You may also like:

Top 7 Amazon Sales Estimators For Amazon FBA Sellers

13 Tips To Help Sellers Increase Amazon Sales

The Complete Guide To Amazon Sales Ranking

Amazon Long Term Storage Fees: 5 Tips FBA Sellers Should Never Miss

Complete Guide on How to Create an Amazon Seller Account

Leave a Reply

You must be logged in to post a comment.